Mutual funds are one of the most lucrative areas where investors can park their funds for the long term to get explanation returns. Moreover, one can find the various asset management companies and financial institutions that offer the best mutual funds for investment. HDFC mutual fund is one such institution known to deliver an extensive range of mutual fund schemes. Known for their consistent performance, experience in management, and great returns, HDFC mutual funds are preferred by investors for long-term investment. Combining the benefits of investing in HDFC mutual funds and systematic investment plans for investment, investors get the best returns that can help them achieve their financial goals.

The following article explores the estimated five-year and 10-year SIP returns of popular HDFC mutual funds that investors must analyze to make sound decisions regarding investment:

1. HDFC Growth Top 100 Mutual Fund:

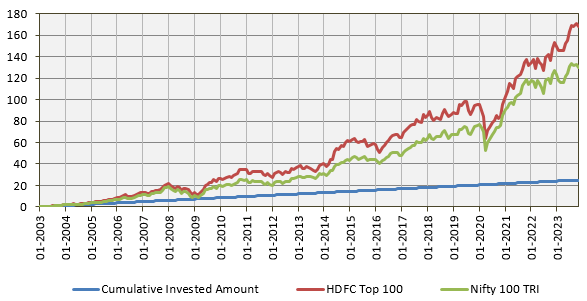

And being a large-cap fund, the HDFC top 100 growth fund comprises stocks of large-cap companies with strong fundamentals. Through complete analysis of its historical performance and using a SIP investment calculator, the following 5-year and 10-year SIP estimates can be concluded:

5 Year SIP estimate:

A SIP of ₹5000 grows to ₹4.3 lakhs with an annual return of 12% invested for 5 years.

10-Year SIP estimate:

A SIP of ₹5000 can grow up to ₹11.5 lakhs with a CAGR of 13% invested for a period of 10 years.

2. HDFC MidCap Opportunities Fund

Consisting of stocks from MidCap companies, the HDFC MidCap Opportunities fund is known for its high-risk level but equivalent growth potential. Following are the 5-year and 10-year SIP estimates:

5 Year SIP estimate:

An investment of ₹5000 with a CAGR of 14% can grow to ₹4.7 lakhs.

10-Year SIP estimate:

An investment of ₹5000 can reach ₹13.8 lakhs with a CAGR of 15% invested for a period of 10 years.

3. HDFC Balanced Advantage Fund

Consisting of both equity and debt-based security, the HDFC balanced advantage fund delivered growth as well as security making it a perfect choice for investors who require returns as well as safety and stability.

5 Year SIP estimate:

₹5000 monthly SIP investment can reach ₹4.2 lakhs with a CAGR of 11%

10-Year SIP estimate:

A SIP of ₹5000 can grow to nearly ₹11 lakhs with a return of 12% CAGR.

4. HDFC Small Cap Fund

Perfect for investors who believe in long-term investment, the HDFC small cap fund includes stocks of companies that are still in their growth phase. These companies offer high growth potential thereby delivering an opportunity to generate expenditure returns.

5 Year SIP estimate:

₹5000 SIP can grow to ₹5 Lakhs with a CAGR of 15%

10-Year SIP estimate:

₹5000 investment can you grow and reach a level of ₹15.5 lakh with a CAGR of 16%

Conclusion

HDFC Mutual Fund offers a great opportunity for investors to invest in small amounts but with consistency. Moreover, with 5-year and 10-year SIP estimates, investors can make a sound decision regarding the selection of the best mutual fund scheme. A SIP calculator can be used as well to identify the correct SIP amount as well as select a mutual fund that can deliver the required returns in a definite period.